Admission in the payment system (SNCE)

- Participating entities in the SNCE

- Direct Participant

- Represented Entity

- Calendar

- Participating entities in the SNCE

Participation in the payment system (SNCE)

Those entities authorized to operate in the European Economic Area (EEA) that comply with the requirements of the SNCE Regulations may be Members of the SNCE.

Entities may participate in the system as direct participants, settling their transactions and submitting them directly to the system; or as represented entities, through a direct participant that settles their transactions, and may submit their transactions directly to the system or do so through their direct participant.

An entity may be a participant in all or part of the subsystems existing in the SNCE.

Procedure to become a Participant in the SNCE

- Entities willing to join the SNCE will send to Iberpay the corresponding SNCE Adhesion Agreement in accordance with the template provided in its Operating Instructions, which will be submitted for approval by the Iberpay’s Governing Bodies, prior the approving report from the SNCE’s Technical Advisory Committee.

- Processing of the request may not exceed three months, and may be denied, by reasoned resolution, when the interested entity does not meet the requirements required by law to become a participant in a Payment System, recognized for the purposes of the Law 41/1999, does not have the organization or the appropriate technical means for its participation and, in general, when there are circumstances that could determine a harm or damage to to the SNCE.

- Once this request has been approved, the correspondent Adhesion Agreement, in accordance with the template provided in the SNCE Operating Instructions, will be signed by the entity and Iberpay, with the acceptance by the entity of the rules of the SNCE Regulations and the applicable SNCE Operative Instructions. This contract will be the act that determines the requesting entity’s incorporation to the SNCE. The incorporation of an entity to the SNCE implies its participation in at least one of the SNCE Subsystems, in the maximum period of 6 months from the submission of its application for incorporation.

Tariffs

For information on fees related to SNCE, please click here.

Documents

To request the Adhesion Agreement to the SNCE, please send an email to regulacionyservicios@iberpay.com.

Direct Participant’s Formal requirements (entity performing settlement):

-

To be an entity eligible to participate in a designated Payment System in accordance with Law 41/1999 (credit institution authorized to operate in the European Economic Area).

-

To hold an account in the Payments Module of TARGET2 with sufficient funds in it and, if applicable, in the sub-accounts of the TARGET2 Payment Module to cover the amounts resulting from the settlement of the transactions of the different subsystems.

-

In the case of the SEPA subsystems, to participate in the corresponding schemes and appear in the EPC’s Register of participants of the corresponding SEPA payment instrument, before the expected date of incorporation into the SNCE.

-

Adherence to any SNCE subsystem (with the exception of SCT and SCT Inst subsystems) implies adherence to the Operaciones Diversas (Other transactions subsystem).

-

To participate in Iberpay’s Bank Branches Information Service.

-

In case of participating in the SEPA SCT Inst subsystem, to participate in Iberpay’s Fraud Prevention Service.

-

To assume the payment obligations derived from the settlement of both its own transactions and those corresponding to the entities it represents.

-

To commit to make the equivalent declaration of notarial protest required by article 51 of Law 19/1985, of July 16, on Bills of Exchange and Cheques, in the terms established by the corresponding Operating Instructions, to the extent that it is applicable in those cases where it is deemed necessary

-

To adhere the SNCE Dispute Resolution Committee.

-

To complete and sign the required formal documentation. To obtain these documents, you may request them by email to: normativa@iberpay.com.

Direct Participant’s Technical requirements:

-

To hold at least 2 physical processing centres located within the EU territory.

-

To have redundancy in the processing centres. Being, at least, two of them independent from each other in terms of resources (supply, communications, security, etc.) and with a sufficient geographical separation to avoid being affected by any natural disasters or terrorist attacks at a regional level. In the case of servers in cloud, in the case of not being able to guarantee geographical separation, a disaster recovery service must be available.

-

To have the access to the SNCE communication networks configured and, in the case of connections with any of the private networks, to have sufficient hosting capacity in the processing centres to install the provider's communications equipment.

-

To hold the corresponding mechanism for the transmission of transactions, according to the selected communication network:

- EDITRAN file transfer software through the SNCE communication networks, or

- sFTP file transfer protocol through the SNCE communication networks for the SCT Inst subsystem, or

- File transfer service FileAct over SWIFT Net and SWIFT Net Bulk Payments, using the Closed User Group (CUG) of Iberpay1.

-

In the case of the SCT Inst subsystem, to have the capacity to develop web applications interacting with SOAP or REST web services.

-

To have, at least, two different environments: test and production. Both environments must have their corresponding software licenses or file transfer services.

-

To have carried out the corresponding certification processes, ensuring the technical capability of the entities at all times.

(1) In the case of choosing the Swift network, the entity must assume Swift's own costs and apply for membership in Iberpay’s Closed User Group (CUG) prior to the tests (CUG test) and the operational start (CUG live).

Formal requirements for a Represented Entity (entity not performing settlement):

-

To be an entity eligible to participate in a designated Payment System in accordance with Law 41/1999 (credit institution authorized to operate in the European Economic Area).

-

To prove a Direct Participant representates it in the subsystem.

-

In the case of the SEPA subsystems, to participate in the corresponding schemes and appear in the EPC’s Register of participants of the corresponding SEPA payment instrument, before the expected date of incorporation into the SNCE.

-

Adherence to any SNCE subsystem (with the exception of SCT and SCT Inst subsystems) implies to also participate in the subsystem "Operaciones Diversas subsystem (Other transactions)".

-

To participate in Iberpay’s Bank Branches Information Service.

-

To commit to make the equivalent declaration of notarial protest required by article 51 of Law 19/1985, of July 16, on Bills of Exchange and Cheques, in the terms established by the corresponding Operating Instructions, to the extent that it is applicable in those cases where it is deemed necessary.

-

To adhere the SNCE Dispute Resolution Committee.

-

To complete and sign the required formal documentation. To obtain these documents, you may request them by email to: normativa@iberpay.com.

Technical requirements for a Represented Entity (entity not performing settlement), without connection with the SNCE

Entities participating in the system as Represented entities, not performing settlement, can present their transactions either through the entity that represents them, or directly, through a direct connection to the SNCE, by participating CICLOM Direct Connection Service.

The technical requirements necessary to participate as a represented entity are:

- With no direct conection to the SNCE: To hold the appropriate processing capacity to perform the functions of sending and receiving transactions and information related to the SNCE

- With Direct Connection2 to SNCE: Same technical requirements are established as those required for Direct Participants.

(2) Direct connection to the SNCE is essential for real-time exchanging subsystems.

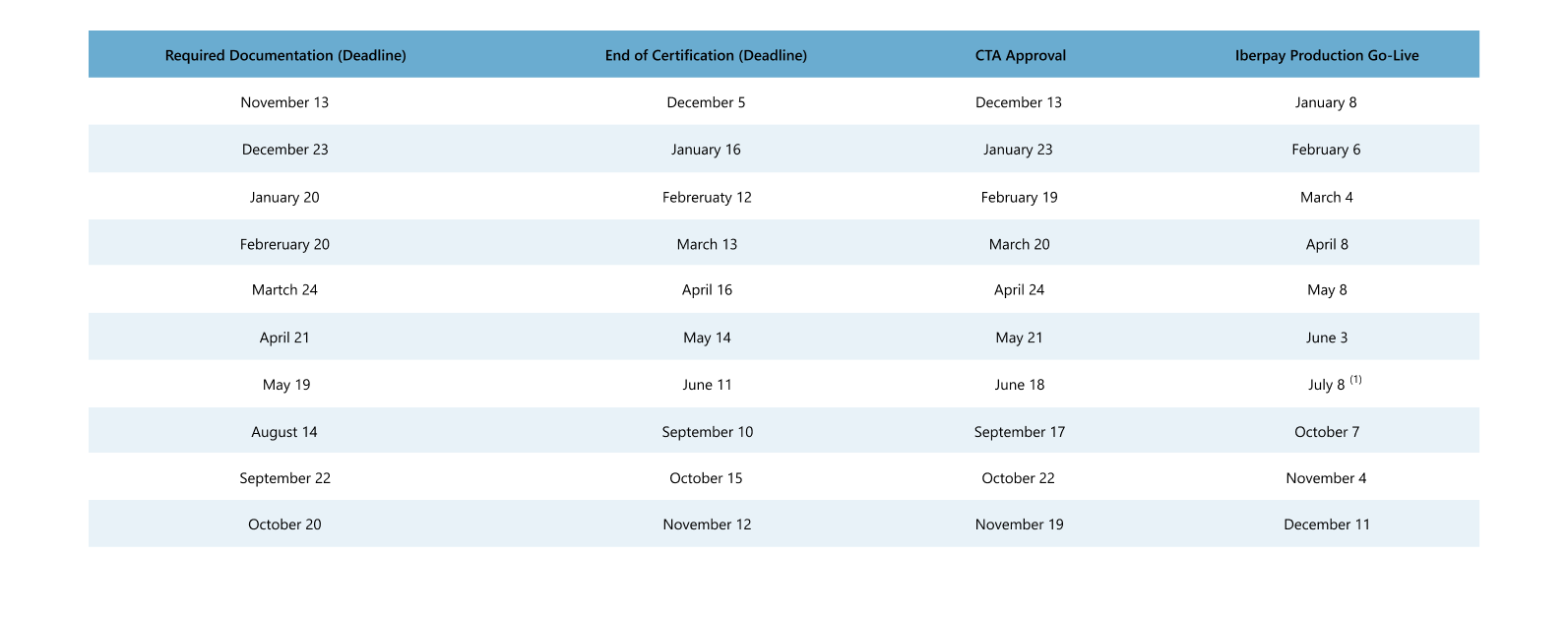

2025 Enrollment Calendar

The enrollment windows established for entities interested in accessing Iberpay's subsystems, gateways, or services during 2025 are as follows:

Note:

- The defined deadlines include the submission of documentation, certification, approval by the Technical Advisory Committee (CTA) when applicable, and the production go-live. It is essential that entities comply with the indicated dates to ensure an orderly and successful enrollment process.

- In applicable cases, it will be necessary to consider the key dates of the EPC and EBA to ensure the corresponding actions are completed within the established deadlines.

(1) Exceptional Go-Live Window.