About the SNCE

Iberpay manages the Payment System (SNCE) through its platform CICLOM. The SNCE comprises the regulatory, operational and technical mechanisms of the retail payment system.

Practically all redit institutions operating in Spain participate in the SNCE which provides them with full reachability to the rest of the European banks operating in the SEPA area (36 countries). The payment system processes, clears and settles payments between bank accounts of its participating entities, mainly: instant credit transfers, credit transfers, direct debits, cheques and bills of exchange.

The Payment System (SNCE) was created in 1987 by Royal Decree 1369/1987, of 18 September. Initially, the management of the SNCE was entrusted to the Bank of Spain but, since 2005, following the reform of Law 41/1999, of 12 November, on payment systems and securities settlement, the management of the SNCE was entrusted to Iberpay (Sociedad Española de Sistemas de Pago, S.A.).

Under different forms of participation for entities, the main functions and features provided by the SNCE are the following:

- Processing payment instruments between current accounts, both domestic and pan-European SEPA, through the participation of entities in the different subsystems of the SNCE.

- Clearing and settlement of transactions processed in central bank money, following the procedures provided by the European Central Bank’s platform TARGET.

- Full accessibility to process payments with European payment systems within the SEPA area, through Iberpay’s links with EBA Clearing, Deutsche Bundesbank, Worldline and KIR; and with the pan-European instant credit transfer services: the Eurosystem’s TIPS service and EBA Clearing’s RT1.

- CICLOM processing platform has an innovative technology designed and developed entirely by Iberpay. Its high processing capacity, maximum availability and resilience, scalability and flexibility, facilitates the end-to-end and automatic processing of transactions.

- Best performance, speed and price per transaction processed in the European context.

- Real-time information system (eCICLOM) to monitor transactional activity, make queries and advanced analysis.

- APIs platform to access the payment system information, automatically and in real-time (CICLOM Open APIs service).

- Technical access through various alternative communication networks, supporting multiple protocols: SOAP and REST web services, EBICS, SWIFT-AGI, EDItran, SWIFT-FileAct, etc.

- Security, Business Continuity and Cyberresilience, applying best practices and international reference standards, with a governance framework and a strategy in line with the Eurosystem's guidelines for Financial Market Infrastructures.

Activity

Activity in 2023

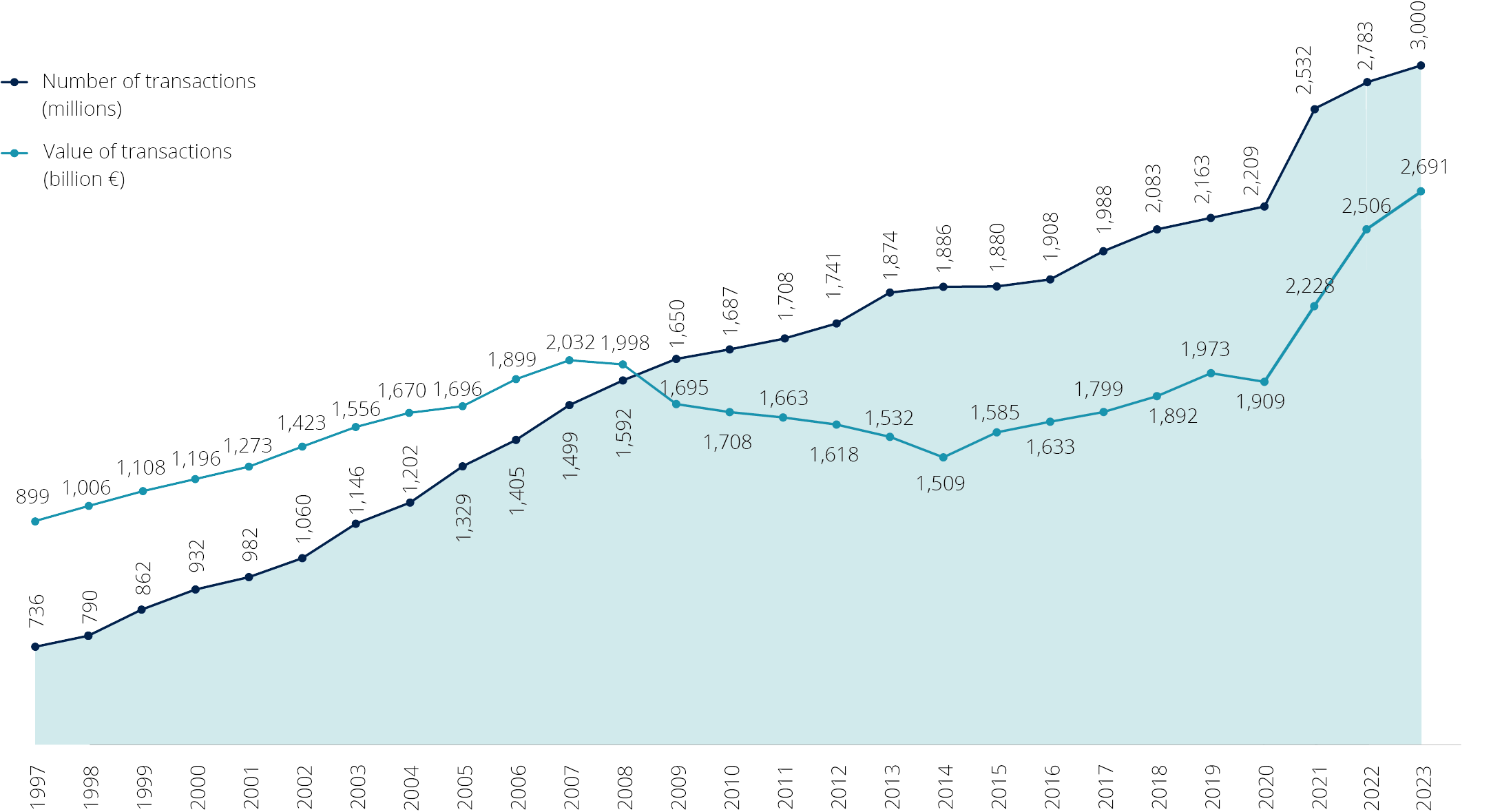

As a summary of the Payment System (SNCE)’s activity in 2023, CICLOM processed 3,000 million transactions (7.8% more than in 2022) for a total value of €2.7 trillion (7.2 more than in the previous year). The SNCE averaged close on 12 million transactions per day, fora total value of €10,724 million, reaching on peak days a maximum of 27,9 million transactions.

Evolution of the SNCE

Payment instruments in the SNCE

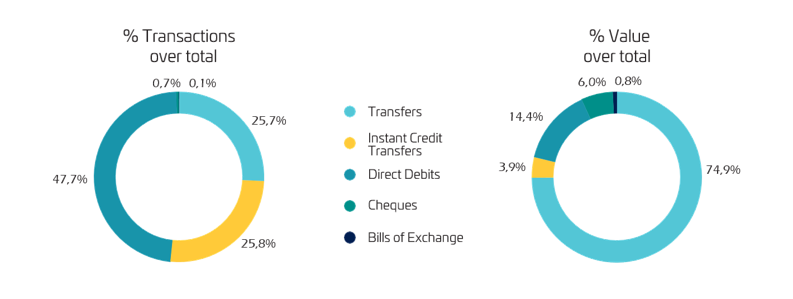

The system consists of different modules or subsystems to process, clear and settlement each of the following payment instruments: direct debts, ordinary credit transfers, instant credit transfers, cheques, bills of exchange and other complementary transactions.

Over half of the total volume of transactions 15.5% of the total value processed in the SNCE are direct debits, whilst the credit transfer is the payment instrument that moves the highest values (72.9), registering the greatest growth in recent years.

Since November 2017, the system processes instant credit transfers, in real-time and 24x7, domestically and to and from European counterparts in the SEPA area. Instant credit transfers hold 22% of the total volume of transations processed in the payment system.

Distribution per instrument in the SNCE in 2023

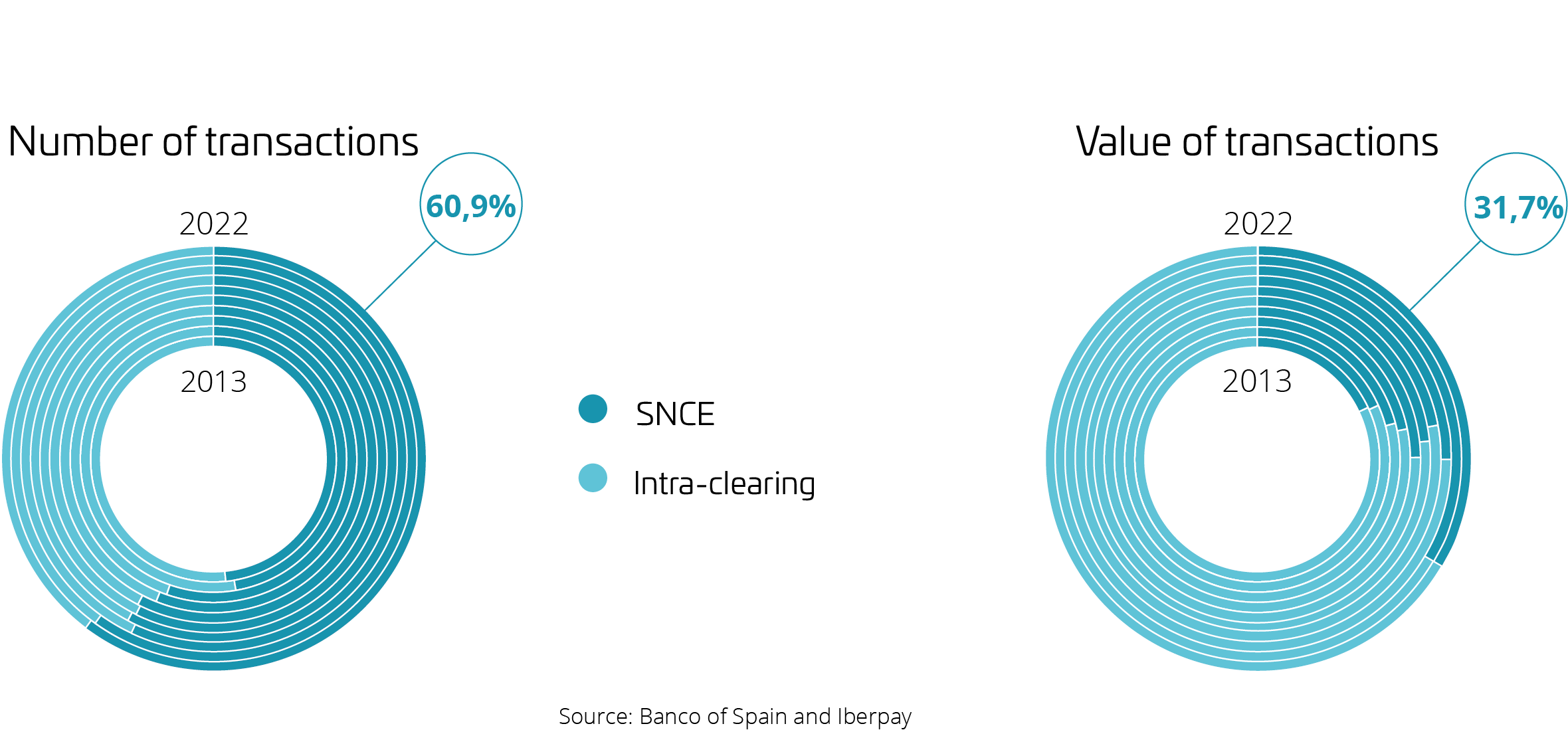

Market share

According to Iberpay's estimations on retail payments, and with the latest data available, the number of transactions processed, cleared and settled through the SNCE in 2022, the payment syste reached 60.9% of total transactions made in Spain. The remaining 39.1% were processed and settled within the entities’ own systems and without being sent though the SNCE (intra-clearing). As for values, the SNCE's share reached 31.7% of the total.

Distribution of Retail Payments in Spain

Interoperability in SEPA

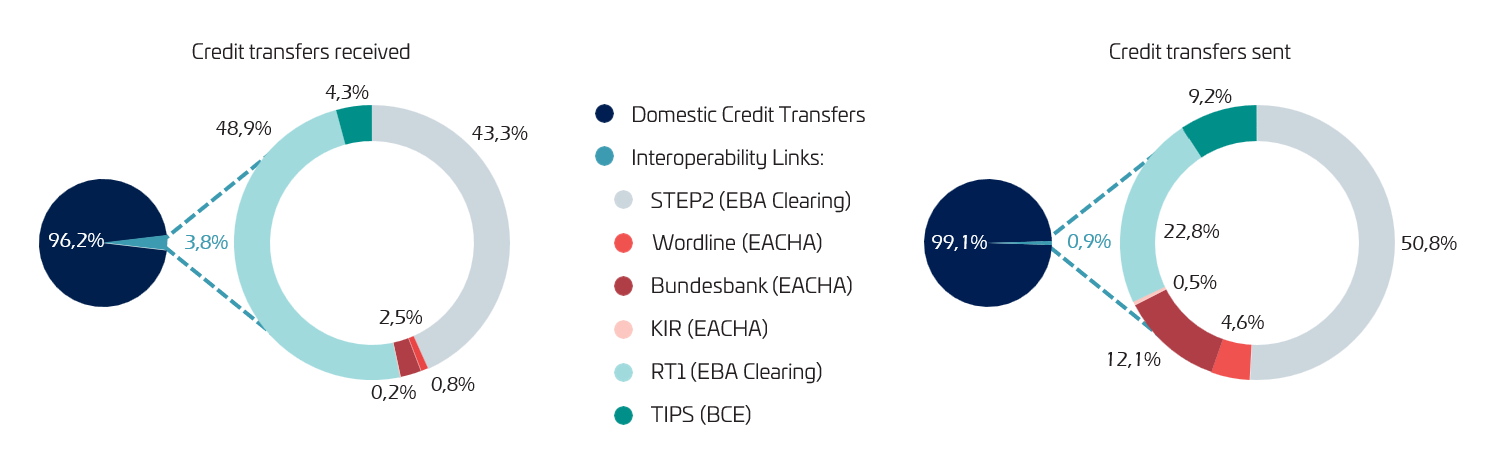

In addition to managing the Spanish Payment System, Iberpay processes international payments in euros as it is connected to the main European payment systems through its six interoperability links to process and settle transactions with over 4,000 entities in SEPA area (36 countries).

Entities use the same technical and operational procedures, formats, messages and standards for either international or domestic transactions, and at the same cost. Thereby, entities do not need to participate in different payment systems, nor have to sign bilateral agreements with other entities.

The SNCE offers two interoperability links for instant credit transfers: Iberpay-RT1 Link, with access to entities participating in EBA Clearing's RT1 service; and the Iberpay-TIPS Link, with access to entities participating in this service of the European Central Bank.

As for ordinary credit transfers, Iberpay-STEP2 Link, with EBA Clearing, and Iberpay-EACHA Link, with the ACHs equensWorldline, Deutsche Bundesbank and KIR, provide access to over 4,000 European entities in the SEPA area.

Entities may process direct debits within the SEPA area with over than 3,900 European entities also through Iberpay’s connection with EBA Clearing’s STEP2 service.

Additionally, Iberpay has an interoperability link with EBA Clearing's R2P service that facilitates the processing of Request to Pay with the participants in this EBA Clearing service. This gateway, however, does not yet have participating entities.

Credit transfers exchanged with other European ACHs in 2023