About the SDA

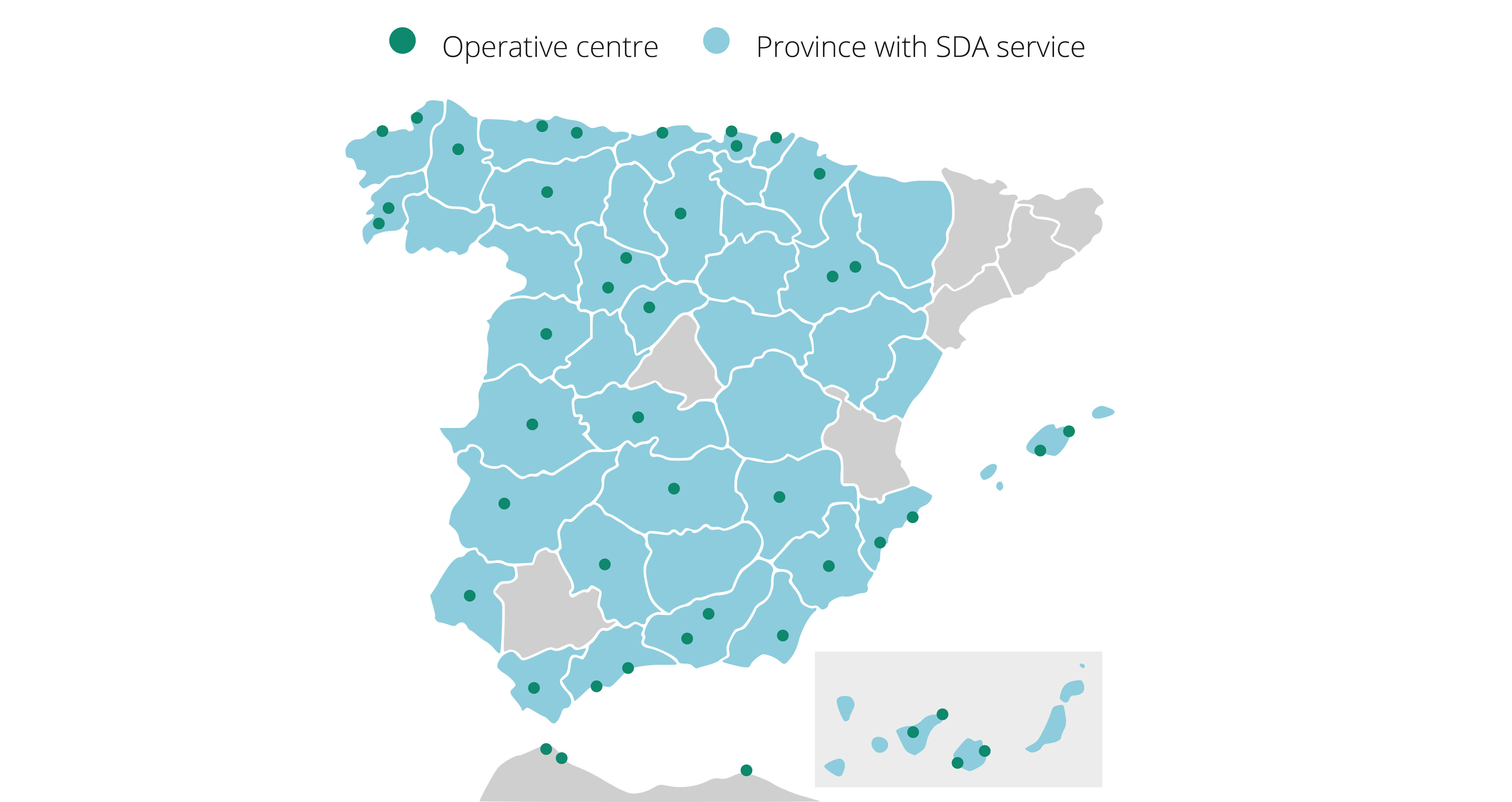

The Spanish Cash Distribution System (SDA) managed and operated by Iberpay, on behalf of Banco de España, facilitates banks the distribution and withdrawal of cash to bank branches throughout a network of operating centres distributed across the Spanish territory. Credit institutions can withdraw and return banknotes these operating centres to meet the public's cash requirements.

This service, which has been in operation since 2005, plays a fundamental role in the logistics of banknote circulation in Spain, by guaranteeing efficiency in the Spanish cash cycle.

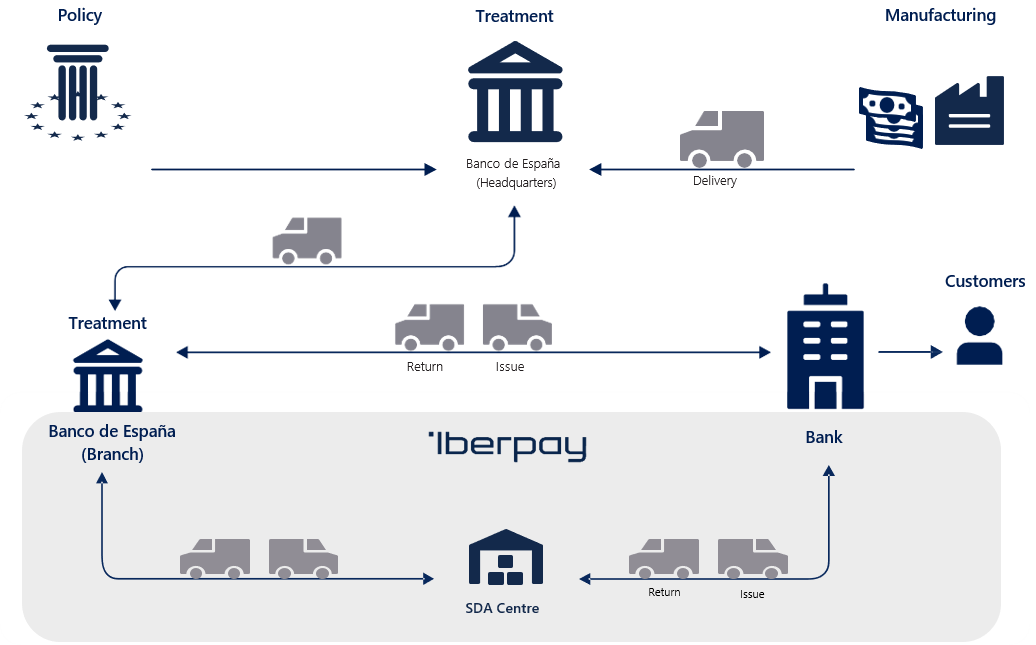

Cash Cycle

How the SDA works

The Cash Distribution System (SDA) has currently of 26 participating banks and 3 cash-in-transit companies that provide services from 46 operational centres.

In the SDA service, banknotes circulate in two directions. Banknotes are distributed to banks following banknote requests from banks to address consumers and companies’ demand. Citizens withdraw cash via ATMs and bank branches and companies receive cash from their business.

Withdrawal of banknotes from banks takes place when merchants and bank customers make cash deposits at their bank offices via means of ATMs and automatic devices. Banks, in turn, deposit notes collected from the public in SDA operating centres.

The service is legally supported by an agreement signed between the Bank of Spain and Iberpay, as well as by the contracts signed between Iberpay, the member entities and the operational managers.

The contribution of this service, provided by Iberpay, to the wholesale distribution of banknotes in Spain is of the order of 70% or, which is the same, of every 10 banknotes that are put into circulation in our country, seven are channeled to through the SDA.

SDA Service

Characteristics of the service

- Cash deposit network owned by Banco de España.

- Adequate resources of notes to cover operational needs of banking entities.

- A double circuit, distribution and withdrawal, to guarantee the quality of banknotes in circulation.

Risk management based on:

- Guaranteed by the entities’ accounts in TARGET2 (ECB).

- Control and inspection mechanisms by the Bank of Spain and Iberpay.

- Operational service based on banknotes delivery against payment.

- Insurance policies signed by cash-in-transit companies in favor of Iberpay.

- Deposits backed by Iberpay and, subsidiarily, by the entities participating in the service.