Iberpay News

Iberpay news

January 28 2025

Iberpay sets new record for transactions and clients in 2024

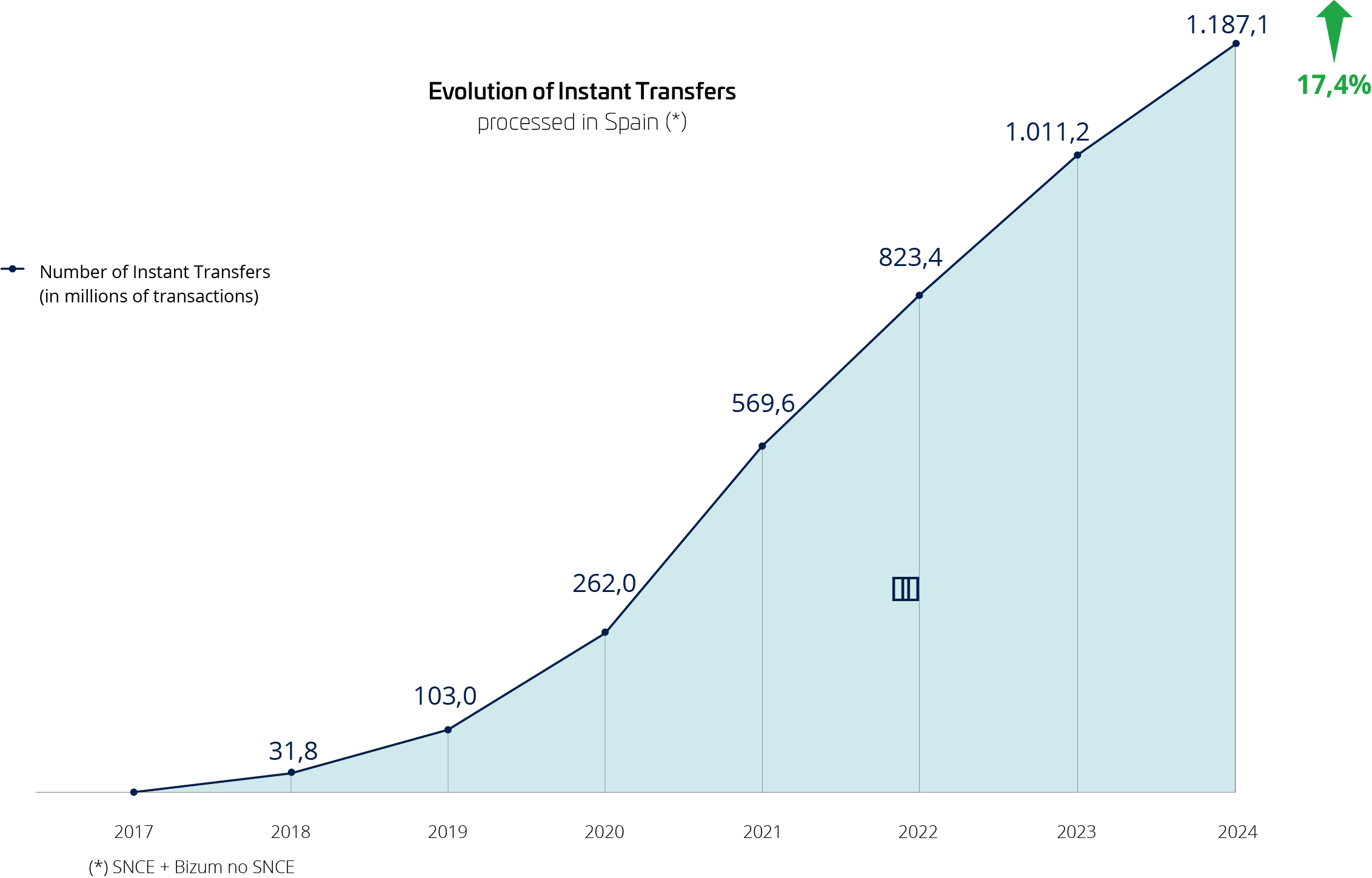

- Instant payments in Spain rise 17.4% by volume and 21.6% by value

- Iberpay's payments infrastructure confirms its position as key payment system in Europe, welcoming 12 new participants and 5 new shareholders

Spain set a new record for instant payments in 2024, processing 1,187.1 million transactions, a 17.4% increase on 2023. Total transaction value was €152,450 million, growth of 21.6% on the year.

Instant payments now account for 55.95% of all transfers made in Spain, making the country a trailblazer in Europe, where the average is just 19.67%. This strong growth shows that users have embraced instant transfers as a new payment standard, appreciated for its speed, 24/7 availability and ease-of-use on digital devices.

What is more, growth is set to accelerate across Europe in 2025 as the measures in Regulation (EU) 2024/886 of the European Parliament and of the Council come into force, driving greater financial digitisation. In Spain the trend is likely to be especially strong in the previously under-represented segments of companies (paying supplier invoices, taking customer payments, payroll, expenses, etc.) and public authorities (handling taxes, fees, subsidies, etc.).

Amid the increasing uptake of instant payments across the world, key bodies like the G20 and the European Commission have set a strategic target of improving cross-border transfers in different currencies, focusing on issues such as speed, transparency, cost, availability and accessibility. A major step forward came in 2024 with the Spanish banking community joining the EPS's One-Leg-Out (OCT Inst) and the Iberpay service, a milestone that makes the Spanish banking sector the first in Europe ready to handle cross-border instant transfers beyond the SEPA area.

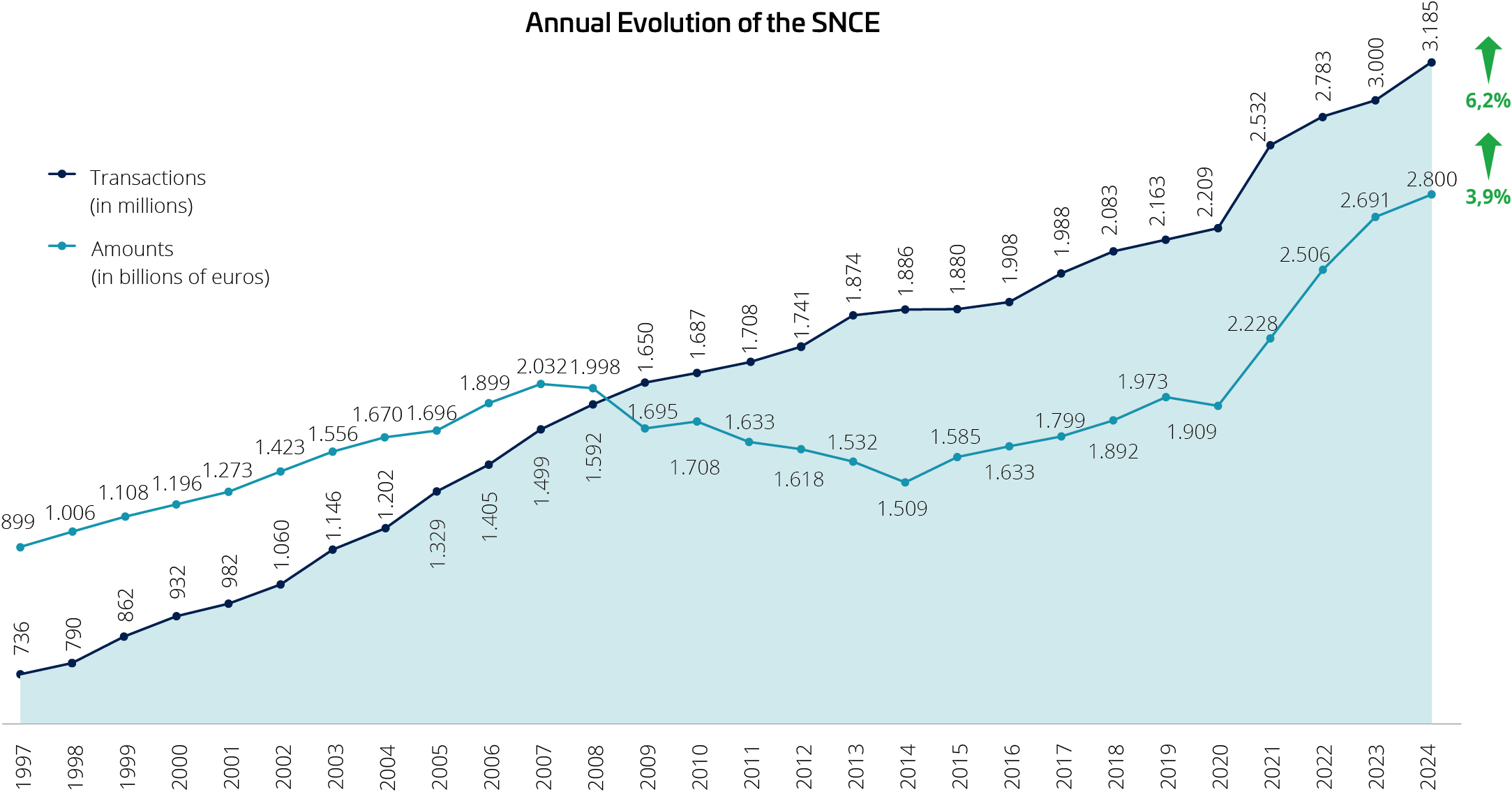

The payment system in 2024

The Spanish national payments system (SNCE) – a European payments infrastructure used by virtually all banks working in Spain and Andorra to clear and settle their account-to-account payments – also set new records in 2024. During the year it handled 3,185 million transactions, 6.2% more than in 2023, with a combined value of €2.8 billion, a 3.9% increase. This means that in an average day it processed 12.5 million transactions, worth a combined €10,998 million

Beating fraud in A2A payments

A top priority for Iberpay and its participant banks is fighting fraud in account-to-account payments. Users need to be sure their payments are safe. Today, banks can count on the state-of-the-art Payguard service, built to detect and anticipate fraud on A2A payments in an ever more digitised environment. Payguard is constantly evolving, and uses AI models trained on mass data volumes with the help of fraud experts drawn from every bank on the service.

In 2024, Payguard had a relevance score of 52%. This means more than half the accounts it flagged were indeed fraudulent and unknown to the banks. Another 20% provided useful sources of information to continue training the model. These success rates for Payguard are a key source of information for banks in the fight against fraud, helping them improve prevention and early detection and deliver more effective payment protections for their customers.

Digitisation and the decline of traditional payments

The shift toward digital payments has already brought a sharp fall-off in the use of traditional (non-SEPA) methods. Physical drafts, such as cheques, bills of exchange and promissory notes, are in decline. Their steady replacement by digital methods will allow systems operators to gradually phase out paper shuffling, streamlining the processing of financial transactions and reducing their environmental footprint. This will mark a significant advance toward more efficient and sustainable payment methods.

In 2024, the system handled 16,264,860 cheques, letters of exchange and credit notes, a fall of 12.0% on the previous year. In the decade from 2014-2024, the use of paper-based payments declined by a cumulative 68.2%. The direction of travel is clearly away from paper and toward more agile, efficient digital methods that better match users’ needs and current trends.

New clients and shareholders

Spain's national payments system signed up 12 new participants in 2024, making a total of 151 from 10 different European countries. This growth underlines how Iberpay is leading the way as one of the most advanced payment infrastructure operators in the European landscape, offering highly innovative services like instant payments, Request to Pay and instant One-Leg-Out (OLO) international payments. Participant banks have seized the opportunity, making a step change in their offering by adopting these innovative services, strengthening their value offer and giving their customers cutting-edge payment solutions.

Iberpay also welcomed 5 new shareholders in 2024: Unicaja, Abanca, Caja Laboral, EVO Banco and Inversis. These latest additions mean it is now backed by 18 shareholders, consolidating its model of sector-wide collaboration and bolstering confidence in the payments infrastructure.

Subscribe to Iberpay’s newsletter

Find out what's new in the world of payments and stay up to date with the industry trends.